Property finance loan refinance refers to the process of replacing your existing mortgage which has a new one. This may be performed to get a reduce desire amount, consolidate financial debt, or adjust the time period with the mortgage. Refinancing your property finance loan generally is a intelligent money move, but it surely’s crucial that you fully realize the method and its potential Rewards prior to making any selections.

What on earth is Mortgage Refinance?

Mortgage loan refinance consists of having out a brand new bank loan to pay back your present home loan. The new mortgage commonly comes along with greater terms—such as a decrease desire price or a different personal loan duration—and can be employed to lower regular payments, shorten the home finance loan phrase, or faucet in the equity of your private home.

Good reasons to Refinance Your House loan

Lower Curiosity Rates: If fascination fees have dropped since you took out your unique property finance loan, refinancing will help you lock in a very lessen rate, which can save you dollars as time passes.

Adjust Personal loan Conditions: Refinancing helps you to regulate the time period within your property finance loan. If you wish to pay back your mortgage more quickly, it is possible to choose a shorter phrase with better monthly payments. Alternatively, you could prolong your bank loan phrase to cut back your month to month payments.

Debt Consolidation: For those who have other higher-fascination debts, refinancing your house loan can give you an opportunity to consolidate All those debts into your house loan, often at a decreased interest charge.

Dollars-Out Refinance: You may be able to access the equity in your house via a dollars-out refinance, which lets you just take out a completely new property finance loan for the next total than you owe and get the primary difference in cash.

How House mortgage refinance loan Refinance Is effective

Examine Your Latest House loan: Overview your existing mortgage conditions and look at irrespective of whether refinancing is sensible for you personally. Listen on the remaining balance, fascination price, and how much time you've remaining with your home loan.

Look at Costs and Terms: Shop around for the best refinance costs. You can operate with a house loan broker to check various lenders and uncover the most suitable choice that satisfies your economical plans.

Think about Fees: Refinancing generally includes closing costs and fees, for example appraisal service fees, legal charges, and application expenses. Make sure to element these fees into your determination when calculating likely discounts.

Submit Your Software: When you finally’ve selected the very best refinancing option, post an application into the lender. The method will contain documentation much like your primary home finance loan, such as evidence of income, credit score record, and property specifics.

Summary

Home loan refinance generally is a beneficial Device to improve your fiscal problem, no matter whether you should lessen your desire level, consolidate personal debt, or regulate your personal loan expression. You'll want to assess your choices, consult with which has a property finance loan broker, and absolutely have an understanding of The prices and Rewards prior to refinancing your home loan.

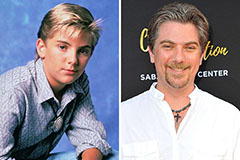

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Traci Lords Then & Now!

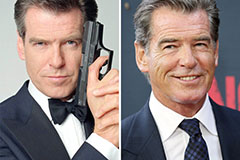

Traci Lords Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!